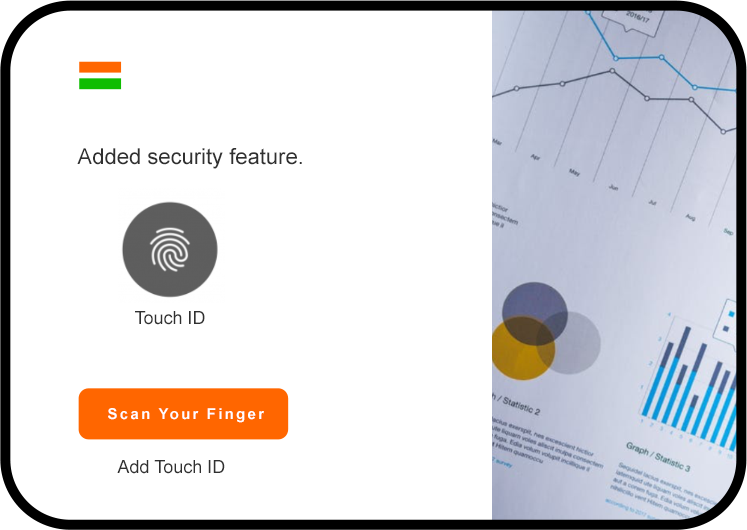

Behavioural Biometrics

Face ID is throne to phone identification. Facial recognition tech has fallen off the tree. It’s not just cool; it’s convenient. Look forward to see how this tech will affect our lives and our ATMs.

Meanwhile, ATMs should adopt biometrics as the new normal to transact money across accounts in rural and urban India.

Not surprised it's being used as a security and authentication tool in the rural banking sector by a group of women.

http://bit.ly/CourageintoCapital

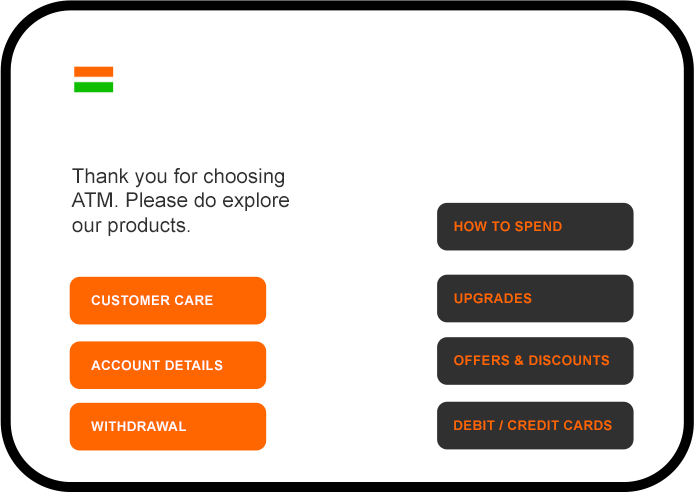

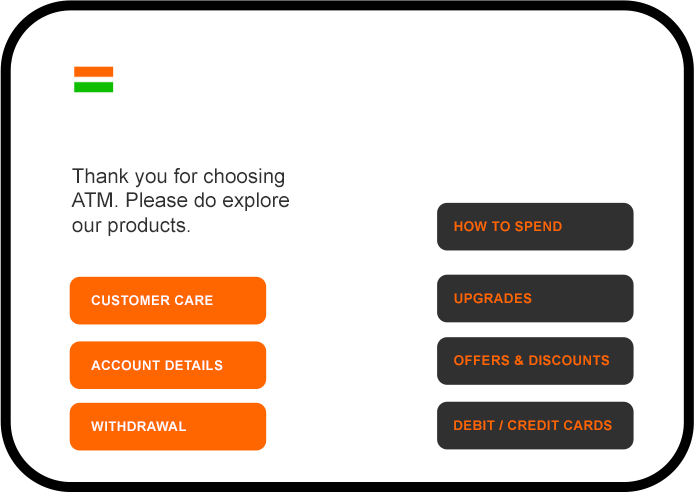

Smart Spending

Build relevant interactions with customers beyond cash transactions, by treating them with immersive experiences and unlimited choices on best ways to spend their money and time - entertainment, retail, food, investing in financial products, and tons more.

Adding a bit of flair, create interactive on-ground immersive experiences with AR or QR codes within the ATM booth, to bring alive recommendations for the customer based on their transaction.